Tax Strike! Saying No to War on April 15

Letter from a War-tax Resister

April 12, 2004

|

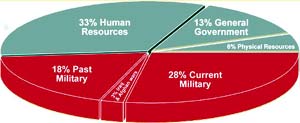

| The White House pie chart on government spending shows military spending accounting for 18% of the federal budget. The War Resisters League pie chart shows the real impact of military spending. For more info, see: www.warresisters.org/piechart.htm. For information on National Campaign for a Peace Tax Fund, contact: The Peace Tax Foundation, 2121 Decatur Place NW, Washington, DC 20008 USA, (Toll-free: (888) PEACETAX; Fax: (202) 986-0667; www.peacetaxfund.org; info@peacetaxfund.org; |

Tax Strike! Saying 'No to War' on April 15

Gar Smith / The-Edge

If you ask the average citizen to identify a famous American war-tax resister, most folks would probably name "Henry David Thoreau." But how about Joan Baez, Noam Chomsky or Gloria Steinem?

While the author of Walden Pond is remembered for the night he spent in a Massachusetts jail for refusing to pay a levy to support the Mexican-American war of 1846, his solitary protest was an anomaly. But 120 years later, Baez, Chomsky and Steinem were joined by more than 500,000 US citizens who openly opposed paying tax tribute to support Washington's bloody campaign in Vietnam.

With tens of millions of Americans marching to protest the Bush administration's invasion of Iraq, the nonviolent tactic of war-tax resistance is gaining converts as tax day approaches on April 15.

And, as before, Baez and company have issued a new Appeal to Conscience proclaiming that citizens have a "moral duty" to oppose Washington's war of occupation by "refusal to pay taxes used to finance unjust wars." Among the citizens opposing the war by resisting federal military taxes are Julia Butterfly Hill and the editor of The-Edge.

For the full text of Julia Butterfly Hill's statement on tax resistance, click here.

For the full text of War Strike, written on April 11, 2003 and syndicated on the AlterNet news service, go to:

www.earthisland.org/project/newsPage2.cfm?newsID=386&pageID=177&subSiteID=44

Letter from a War-tax Resister

Content of a letter to the IRS upon receipt of a notification of seizure.

Individuals have international duties which transcend the national obligations of obedience...Therefore [individual citizens] have the duty to violate domestic laws to prevent crimes against peace and humanity from occurring.

-- Nuremberg War Crime Tribunal, 1950

Dear IRS:

Your February 23, 2004 Notice # CP 504 is incorrect.

I did pay my 2002 tax. I sent the IRS two checks -- both for $76. The IRS honored one of my checks (by forwarding it to UNICEF) but returned the second check, which was made out to the US Department of Education.

Since the US budget included $120 million in payments to UNICEF, I consider the forwarded check to stand in mitigation of the US' budgeted obligations to UNICEF.

The IRS declined to honor my check to the Department of Education and returned the payment without explanation.

In my initial letter to the IRS, I explained that I could not morally volunteer financial support to the prosecution of pre-emptive warfare, illegal invasions of sovereign countries and the military occupation of foreign cultures -- all of which are violations of international law.

I specifically cited an individual's responsibility under international law established by the Nuremberg Tribunal and elaborated by a succession of widely ratified international treaties.

My concern was that, under binding international laws ratified by the US Congress, my voluntary support of international war crimes and crimes against humanity would leave be prosecutable under a number of enforceable statutes.

Still Awaiting a Promised Response from the IRS

In three separate letters, the IRS has informed me that it was unable to respond to my situation because it had received a large number of "similar requests." I have been told to expect a reply addressing my concerns "within 45 days."

I have waited patiently but have yet to receive the promised response from the IRS.

Former United States Attorney General Ramsey Clark articulated seven points on which the US invasion of Iraq stands as a violation of international law. By clear definition under these standards of global jurisprudence, the Bush administration has planned, engaged in and promulgated illegal acts of aggression.

Attorney General Clark's brief (excerpted below from a letter to the UN dated January 20, 2004) includes the following seven particulars:

The US Is Guilty of Waging a 'War of Aggression'

The UN General Assembly Resolution on the Definition of Aggression of December 14, 1974 provides in part:

Article 1: Aggression is the use of armed force by a State against the sovereignty, territorial integrity or political independence of another State;

Article 2: The first use of armed force by a State in contravention of the Charter shall constitute prima facie evidence of an act of aggression;

Article 3: Any of the following acts ... qualify as an act of aggression:

(a) The invasion or attack by the armed forces of a State of the territory of another State, or any military occupation, however temporary, resulting from such invasion or attack;

(b) Bombardment by the armed forces of a State against the territory of another State or the use of any weapons by a State against the territory of another State;

(c) The blockade of the ports or coasts of a State by the armed forces of another State;

(d) An attack by the armed forces of a State on the land, sea or air forces, or marine and air fleets of another State.

The US Is Waging an Illegal War of Aggression

If the US assault on Iraq is not a War of Aggression under international law, then there is no longer such a crime as War of Aggression. A huge, all-powerful nation has assaulted a small prostrate, defenseless people half-way around the world with "Shock and Awe" terror and destruction.

The first crime defined in the Constitution annexed to the Charter of the International Military Tribunal (Nuremberg) under Crimes Against Peace is War of Aggression. II.6.a. The Nuremberg Judgment proclaimed:

"The charges in the indictment that the defendants planned and waged aggressive war are charges of the utmost gravity. War is essentially an evil thing. Its consequences are not confined to the belligerent states alone, but affect the whole world."

To initiate a war of aggression, therefore, is not only an international crime, it is the supreme international crime.

Adolph Hitler's "seizure" of Austria in March 1938 (and of Bohemia and Moravia from Czechoslovakia in March 1939) were judged to be acts of aggression by the Tribunal, even in the absence of actual war.

The first conduct judged to be a war of aggression by Nazi Germany was its invasion of Poland in September 1939. Nazi Germany's attack on the USSR, together with Finland, Romania and Hungary, was adjudged as follows:

It was contended for the defendants that the attack upon the USSR was justified because the Soviet Union was contemplating an attack upon Germany, and making preparations to that end. It is impossible to believe that this view was ever honestly entertained.

The plans for the economic exploitation of the USSR, for the removal of masses of the population, for the murder of Commissars and political leaders, were all part of the carefully prepared scheme launched on 22 June without warning of any kind, and without the shadow of legal excuses. It was plain aggression.

Growing Concerns about Culpability under War Crime Statues

In February, a British translator named Katherine Gun was released on charges of violating her country's Official Secrets Act. Gun had disclosed a secret US-UK intelligence operation to spy on the private phone conversations of UN Secretary-General Kofi Annan. Observers were baffled when the British government suddenly announced that it would not proceed with Gun's trial. The reason cited is based on recognition of a citizen's right to place moral authority and international law above political expediency.

As the Washington Post explained: "The head of the prosecution service, Ken MacDonald, elaborated briefly on the reasons in a statement... saying officials believed they would be unable to disprove Guns' claim of the defense of necessity -- that she had acted out of conscience to prevent an illegal war."

Apparently the UK government feared that a court trial would inevitably establish the illegality of the US-UK preemptive invasion and occupation of Iraq. In so doing, the British government acknowledged the primacy of the "defense of necessity."

UK Generals Feared being Tried for 'War Crimes'

On February 29, 2004, the London Observer revealed that "Britain's Army chiefs refused to go to war in Iraq amid fears over its legality just days before the British and American bombing campaign was launched. Refusing to commit troops already stationed in Kuwait, senior military leaders were adamant that war could not begin until they were satisfied that neither they nor their men could be tried. Some 10 days later, Britain and America began the campaign." UK Attorney General Lord Goldsmith also wrote to Blair at the end of January voicing concerns that the war might be illegal without a second resolution from the United Nations

http://observer.guardian.co.uk/politics/story/0,6903,1158801,00.html

British Leaders could Stand Trial for War Crimes

On March 2, 2004 the London Guardian reported that a group of anti-war lawyers planned to indict Tony Blair and the foreign and defense secretaries for war crimes over the invasion of Iraq. The group Legal Action Against War have submitted a petition to the International Criminal Court (ICC) in the Hague, asking the court to investigate alleged offences by Mr Blair, Jack Straw, Geoff Hoon, and the attorney general, Lord Goldsmith.

The group said "a principal charge" was "intentionally launching an attack knowing that it will cause incidental loss of life or injury to civilians". The legal team said the reasons given for the war -- from weapons of mass destruction to the violation of UN resolutions and regime change --were not justified under the UN charter.

Questions Remain: New Questions Have Arisen

Since my original letter was sent, other issues have arisen and I have addressed my concerns to the IRS seeking elaboration. I have asked the IRS to respond to the case of the IRS vs. Vernice Kuglin.

Since my last letter to the IRS, two other cases have come to my attention. - An employer who refused to withhold employees' wages on behalf of the IRS was arrested and tried in US Federal Court in San Francisco where he was acquitted of the charges. I understand that the government may seek a retrial. What is the IRS' position on the legality of the withholding provision?

- A former IRS agent named Joseph Banister has publicly maintained that there is no provable, legal foundation that compels citizens to pay federal income taxes. According to this former IRS agent, this discovery made it morally impossible for him to continue to perform his duties as an agent of the IRS. He informed his superiors that he would willingly resume his duties if they could clearly establish the legality of the current tax system. When his supervisors refused to offer the requested evidence, Mr. Banister resigned. What is the IRS' opinion on the challenges raised by Mr. Banister prior to his resignation?

Payments at this Time would Constitute a Hardship

The loss of 7 million jobs over the past three years is, in part, attributable to the misappropriation of the trillions of dollars that have been channeled into the Pentagon's budget.

As the San Francisco Chronicle reported on May 18, 2003: "The Department of Defense, already infamous for spending $640 for a toilet seat, once again finds itself under intense scrutiny, only this time because it couldn't account for more than a trillion dollars in financial transactions, not to mention dozens of tanks, missiles and planes."

Moral and legal issues aside, the current, prolonged economic recession would make it difficult for me to volunteer payment of federal taxes. I would find it a hardship to pay taxes at this particular time. I have been unemployed for more than a year and have had to deplete nearly all of my savings. I have less than $500 in my bank account.

The economic policies of the Bush administration cost me the $48,000 salary that went with my job of 16 years. Nonetheless, I am still willing to contribute funds to the country.

Once again, I am mailing two checks to the IRS (as I did last April). One is a check written out to the US Department of Education; the other is written out to the US Environmental Protection Agency.

Both checks are for $10. I hope to be able to volunteer similar payments in the months ahead. Future payments, however, remain conditional on my success in finding new paid employment.

I hope that the IRS will accept these checks. I believe that citizens should be permitted to support the federal programs that they believe in. Citizens should not be coerced into having their earnings extorted to support illegal acts. Threatening citizens with liens, forfeitures and [jail time?] are acts of petty fiscal terrorism that are wholly inimical to a civilized democracy.

I support the campaign for a National Peace Tax as a means of permitting individuals with sincere moral and religious convictions to contribute only to the life-enhancing programs of the government.

I offer these checks in the spirit of good citizenship, in the spirit of just governance, and in the spirit of moral stewardship.

Sincerely,

Gar Smith

For more information contact: